montana sales tax rate 2021

The Montana State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Montana State Tax CalculatorWe also provide. 2021 Individual Income Tax Returns filed on extension are due October 17 2022.

General Sales Taxes And Gross Receipts Taxes Urban Institute

AUGUST 31 2021.

. Look up 2022 sales tax rates for Clyde Park Montana and surrounding areas. The state sales tax rate in Montana is 0000. We have tried to include all the cities that come.

The minimum combined 2022 sales tax rate for Montana City Montana is. 2022 Montana state sales tax. The State of Montana imposes a variety of registration fees on motor vehicles trailers and recreational.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. There is 0 additional tax districts that applies to some areas geographically within Helena. Montana Sales Tax Rates 2021.

Exemptions to the Montana sales tax will vary by state. State State Sales Tax Rate Rank Avg. Choose the Sales Tax Rate.

Montana is one of the five states in the USA that have no state sales tax. 100 Working Montana sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. Log into My Revenue.

Tax rates are provided by Avalara and updated monthly. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Because there is no.

Method to calculate Montana sales tax in 2021. There are a total of 68. The Department of Justice.

What is the sales tax rate in Montana City Montana. Withholding Tax Guide with Montana Withholding. This is the total of state county and city sales tax rates.

Exact tax amount may vary for different items. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The December 2020 total local sales tax rate was also 0000.

Montana charges no sales tax on purchases made in the state. Withholding Tax Guide with Montana Withholding Tax Tables. Tax rates last updated in August 2022.

7 rows In Montana theres a tax rate of 1 on the first 0 to 3100 of income for single or married. Income Tax Rates Deductions and Exemptions. Sales tax region name.

The Montana sales tax rate is 0 as of 2021 and no local sales tax is collected in addition to the MT state tax. Vehicle owners to register their cars in Montana. There are no local taxes beyond the state rate.

Income Tax Rates Deductions and Exemptions. You can find your sales tax rates using the below table please use the search option for faster searching. Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate.

Average Sales Tax With Local. MT QuickFile is for filing a Montana State Tax Return Only. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

State. While Montana has no statewide sales tax some municipalities and cities especially large tourist. 2022 Montana Sales Tax Table.

States With The Highest Lowest Tax Rates

How Much Does Your State Rely On Sales Taxes Tax Foundation

Montana Income Tax Calculator Smartasset

What Small Business Owners Need To Know About Sales Tax

States With The Highest Lowest Tax Rates

State Sales Tax Rates 2022 Avalara

Taxes Fees Montana Department Of Revenue

Fuel Taxes In The United States Wikipedia

States Without Sales Tax Article

Utah Sales Tax Small Business Guide Truic

General Sales Taxes And Gross Receipts Taxes Urban Institute

States Without Sales Tax Article

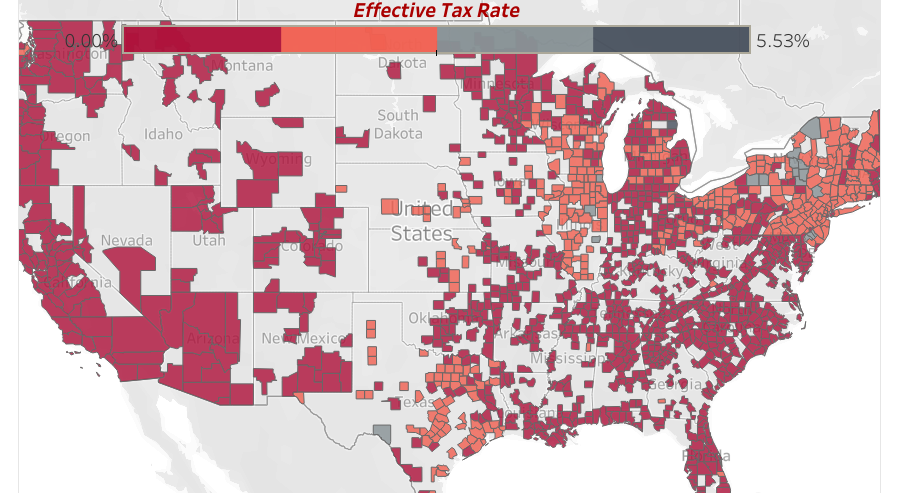

Property Taxes Levied On Single Family Homes Up 5 4 Percent In 2020 To More Than 323 Billion Dfd News

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Montana Tax Information Bozeman Real Estate Report

State Sales Tax Rates 2022 Avalara

Montana Income Tax Information What You Need To Know On Mt Taxes

How Long Has It Been Since Your State Raised Its Gas Tax Itep